Fixed lump-sum loans with clear terms, ideal for specific projects, debt consolidation, or business capital.

Flexible revolving credit for cash flow management and short-term financial needs, borrowing up to a set limit.

Tailored funding for machinery, tools, or technology, with the equipment as collateral.

Hard money loans with quick approval, popular among real estate investors and those with credit issues.

Diverse financial solutions including loans, lines of credit, and specialized financing for business growth and capital.

Interim financing for immediate expenses, often used in real estate, ensuring smooth transitions until long-term financing.

Flexible home equity lines for various needs like home improvements, education, or debt consolidation.

Credit score enhancement services that identify and dispute inaccuracies, offering strategies for better credit.

NO ONE GETS DENIED!

Proven Success and Reliability: Understand Why Our Financial Services Stand Out in the Industry

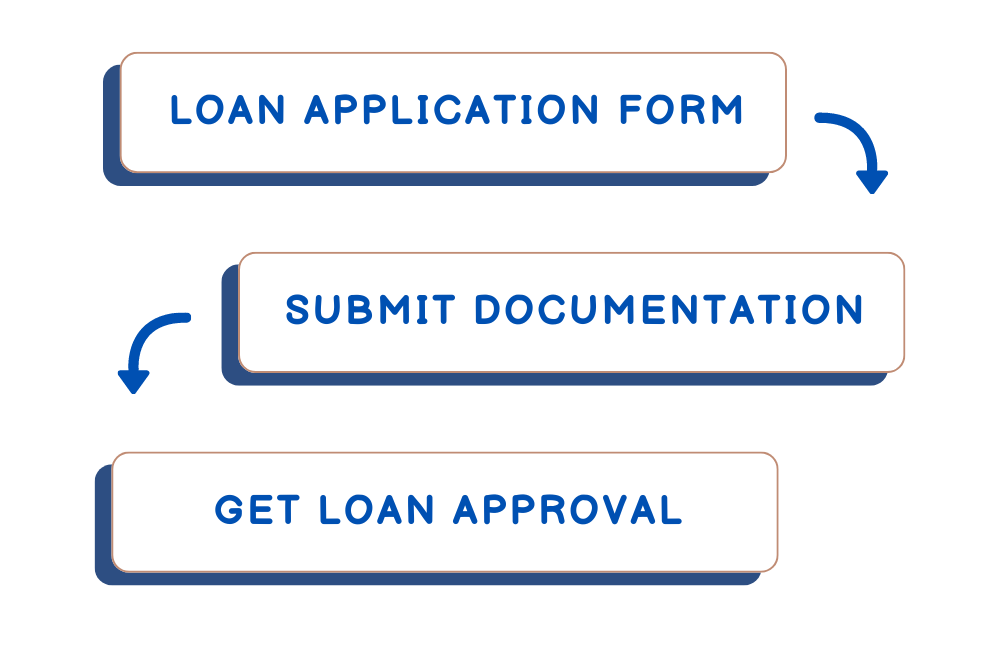

We prioritize your ease and convenience, making the loan experience as hassle-free as possible.

No hidden fees or surprises—our commitment to transparency is unwavering.

Choose from a range of flexible loan options crafted to accommodate your specific requirements.

Trusted by 250 Thousands Users Globally: Join Our Growing Community Today

Partnered with Over 10,000 Businesses Worldwide: Experience Our Proven Financial Solutions

Wow!!! Amazing service! I needed help with my credit for a car loan. Sal and his team were incredible, fixing many issues and raising my score by over 120 points! The package price was affordable, and Sal explained everything clearly. He under promised and over delivered. I highly recommend Sal and his team at iFinancial GROUP..

Rockbomb 2018

Head of financeThis company is the best, 10 out of 10, I would give them 20 out of 10 if I could. It's rare to find a company that genuinely cares about its clients. I'll be a lifelong client. They fixed my credit, got me funding, and made me feel like I made friends. Thank you Sal, Alex, and Jayden!

Alex Aarons

Finance ExecutiveHad such a great experience working with iFinancial. I needed my credit repaired and long term financing options and they delivered on both! They were able to get my credit from a 600 to over 700 and was able to secure me financing at low rates for my business in a short time frame. Highly recommend!

Coco Renee

PHP DeveloperWorking with Sal and his team to repair my credit and secure business funding was a pleasure. They took the time to listen and develop a plan tailored to my needs. They did everything they promised and more. They exceeded my expectations, allowing me to accelerate my business growth and meet demand. Highly Recommended

Sajad Khan

Finance ManagerSal at iFinancial has been wonderful to work with. He guided me through the SBA process to secure crucial funding for my business when no one else could. Sal has become a big supporter of my business and a friend. I highly recommend iFinancial if you're considering working with them. They really care about their clients' success.

Peter Callan

CFOFind Answers to Common Questions:

Our FAQs Cover Various Financial Topics to Help You Better Understand

The time to receive funds after approval varies but typically takes 1-5 days business days, depending on the type of loan and the completeness of your documentation.

Term Loans, Lines of Credit, Equipment Financing, Bridge Loans, as well as many others, all depending on the best situation, rates, and terms.

Very little documentation is required for most of our loans. Please call 866-232-2858 for more information.

Our approval process involves a thorough evaluation of your credit history, financial statements, business plan, and overall eligibility, with a focus on ensuring a secure and suitable financing arrangement.

We consider a range of factors beyond just credit score, and we can work with you to explore financing options that may be available to your specific situation.

A secured loan requires collateral, such as business assets, providing a lower risk for the bank, while an unsecured loan doesn’t require collateral but may have higher interest rates due to increased risk.

The amount of financing you need should align with your business’s specific goals and requirements, which we can help determine through a detailed financial assessment

NO! There are no prepayment penalties.